Notes to the

consolidated

financial statements

continued

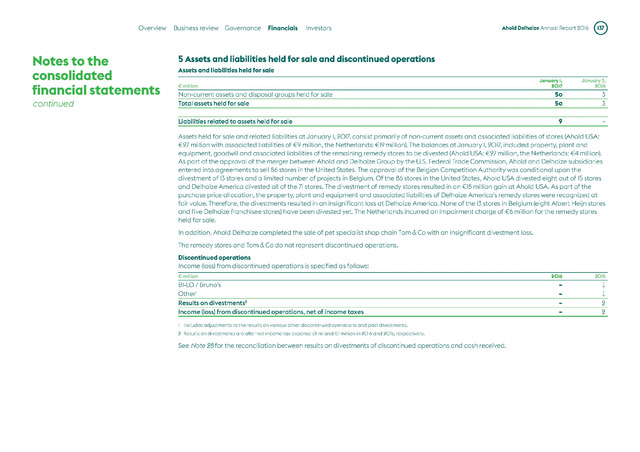

5 Assets and liabilities held for sale and discontinued operations

Overview

Business review

Governance

Financials

Investors

Ahold Delhaize Annual Report 2016

Liabilities related to assets held for sale

9

In addition, Ahold Delhaize completed the sale of pet specialist shop chain Tom Co with an insignificant divestment loss.

The remedy stores and Tom Co do not represent discontinued operations.

2016

See Note 28 for the reconciliation between results on divestments of discontinued operations and cash received.

Assets and liabilities held for sale

Assets held for sale and related liabilities at January 1, 2017, consist primarily of non-current assets and associated liabilities of stores (Ahold USA:

€27 million with associated liabilities of €9 million, the Netherlands: €19 million). The balances at January 1, 2017, included property, plant and

equipment, goodwill and associated liabilities of the remaining remedy stores to be divested (Ahold USA: €27 million, the Netherlands: €4 million).

As part of the approval of the merger between Ahold and Delhaize Group by the U.S. Federal Trade Commission, Ahold and Delhaize subsidiaries

entered into agreements to sell 86 stores in the United States. The approval of the Belgian Competition Authority was conditional upon the

divestment of 13 stores and a limited number of projects in Belgium. Of the 86 stores in the United States, Ahold USA divested eight out of 15 stores

and Delhaize America divested all of the 71 stores. The divestment of remedy stores resulted in an €18 million gain at Ahold USA. As part of the

purchase price allocation, the property, plant and equipment and associated liabilities of Delhaize America’s remedy stores were recognized at

fair value. Therefore, the divestments resulted in an insignificant loss at Delhaize America. None of the 13 stores in Belgium (eight Albert Heijn stores

and five Delhaize franchisee stores) have been divested yet. The Netherlands incurred an impairment charge of €6 million for the remedy stores

held for sale.

1 Includes adjustments to the results on various other discontinued operations and past divestments.

2 Results on divestments are after net income tax expense of nil and €1 million in 2016 and 2015, respectively.

January 1,

2017

50

50

million

Non-current assets and disposal groups held for sale

Total assets held for sale

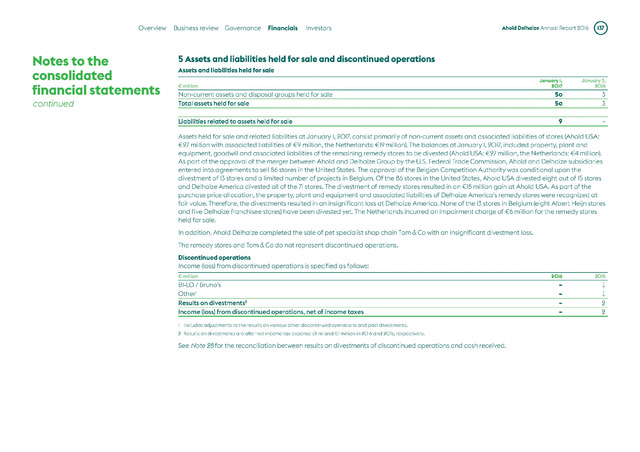

Discontinued operations

Income (loss) from discontinued operations is specified as follows:

million

BI-LO Bruno’s

Other1

Results on divestments2

Income (loss) from discontinued operations, net of income taxes

January 3,

2016

3

3

2015

“T

1

2

2