Notes to the consolidated financial statements

105

20 Equity attributable to common shareholders (continued)

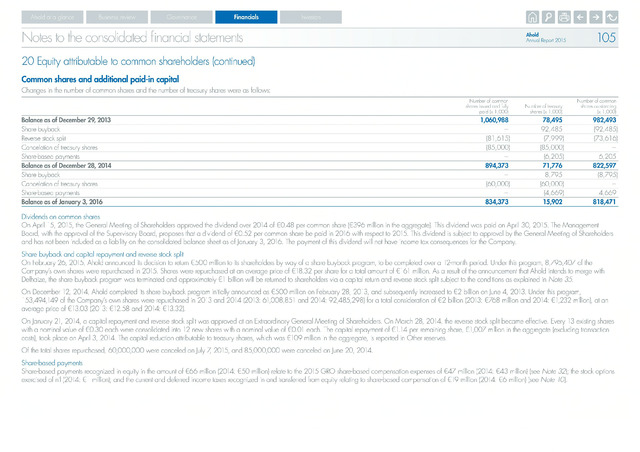

Common shares and additional paid-in capital

Dividends on common shares

Ahold at a glance

Business review

Governance

Financials

Ahold

Annual Report 2015

Changes in the number of common shares and the number of treasury shares were as follows:

Number of commor

shares issued and fully

paid (x 1,000)

Number of treasury

shares (x 1,000)

Number of common

shares outstanding

(x 1,000)

Balance as of December 29, 2013

1,060,988

78,495

982,493

Share buyback

92,485

(92,485)

Reverse stock split

(81,615)

(7,999)

(73,616)

Cancelation of treasury shares

(85,000)

(85,000)

Share-based payments

(6,205)

6,205

Balance as of December 28, 2014

894,373

71,776

822,597

Share buyback

8,795

(8,795)

Cancelation of treasury shares

(60,000)

(60,000)

Share-based payments

(4,669)

4,669

Balance as of January 3, 2016

834,373

15,902

818,471

On April 15, 2015, the General Meeting of Shareholders approved the dividend over 2014 of €0.48 per common share (€396 million in the aggregate). This dividend was paid on April 30, 2015. The Management

Board, with the approval of the Supervisory Board, proposes that a dividend of €0.52 per common share be paid in 2016 with respect to 2015. This dividend is subject to approval by the General Meeting of Shareholders

and has not been included as a liability on the consolidated balance sheet as of January 3, 2016. The payment of this dividend will not have income tax consequences for the Company,

Share buyback and capital repayment and reverse stock split

On February 26, 2015, Ahold announced its decision to return €500 million to its shareholders by way of a share buyback program, to be completed over a 12-month period. Under this program, 8,795,407 of the

Company's own shares were repurchased in 2015. Shares were repurchased at an average price of €18.32 per share for a total amount of €161 million. As a result of the announcement that Ahold intends to merge with

Delhaize, the share buyback program was terminated and approximately €1 billion will be returned to shareholders via a capital return and reverse stock split subject to the conditions as explained in Note 35.

On December 12, 2014, Ahold completed its share buyback program initially announced as €500 million on February 28, 2013, and subsequently increased to €2 billion on June 4, 2013. Under this program,

153,494,149 of the Company's own shares were repurchased in 2013 and 2014 (2013: 61,008,851 and 2014: 92,485,298) for a total consideration of €2 billion (2013: €768 million and 2014: €1,232 million), at an

average price of €13.03 (2013: €12.58 and 2014: €13.32).

On January 21, 2014, a capital repayment and reverse stock split was approved at an Extraordinary General Meeting of Shareholders. On March 28, 2014, the reverse stock split became effective. Every 13 existing shares

with a nominal value of €0.30 each were consolidated into 12 new shares with a nominal value of €0.01 each. The capital repayment of €1.14 per remaining share, €1,007 million in the aggregate (excluding transaction

costs), took place on April 3, 2014. The capital reduction attributable to treasury shares, which was €109 million in the aggregate, is reported in Other reserves.

Of the total shares repurchased, 60,000,000 were canceled on July 7 2015, and 85,000,000 were canceled on June 20, 2014.

Share-based payments

Share-based payments recognized in equity in the amount of €66 million (2014: €50 million) relate to the 2015 GRO share-based compensation expenses of €47 million (2014: €43 million) (see Note 32); the stock options

exercised of nil (2014: €1 million); and the current and deferred income taxes recognized in and transferred from equity relating to share-based compensation of €19 million (2014: €6 million) (see Note 10