Notes to the consolidated financial statements

104

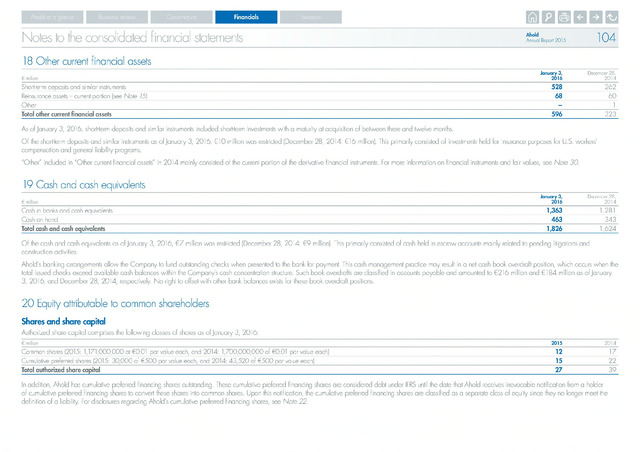

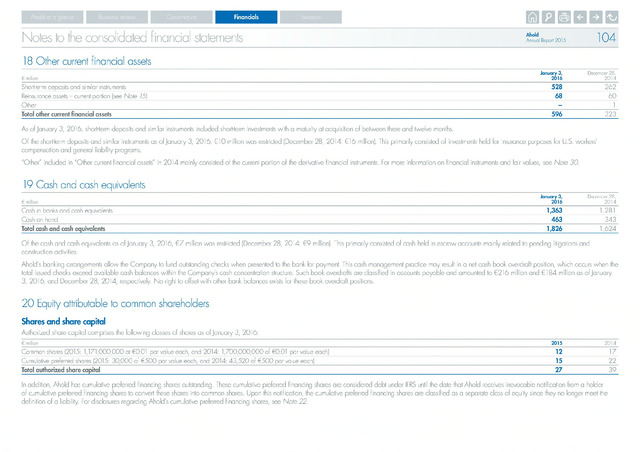

18 Other current financial assets

-

19 Cash and cash equivalents

20 Equity attributable to common shareholders

Shares and share capital

Ahold at a glance

Business review

Governance

Financials

Ahold

Annual Report 2015

millior

January 3,

2016

December 28,

2014

Short-term deposits and similar instruments

528

262

Reinsurance assets - current portion (see Note 15)

68

60

Other

1

Total other current financial assets

596

323

As of January 3, 2016, short-term deposits and similar instruments included short-term investments with a maturity at acquisition of between three and twelve months.

Of the short-term deposits and similar instruments as of January 3, 2016, €10 million was restricted (December 28, 2014: €16 million). This primarily consisted of investments held for insurance purposes for U.S. workers'

compensation and general liability programs.

"Other" included in "Other current financial assets" in 2014 mainly consisted of the current portion of the derivative financial instruments. For more information on financial instruments and fair values, see Note 30.

January 3,

December 28,

million

2016

2014

Cash in banks and cash equivalents

1,363

1,281

Cash on hand

463

343

Total cash and cash equivalents

1,826

1,624

Of the cash and cash equivalents as of January 3, 2016, €7 million was restricted (December 28, 2014: €9 million). This primarily consisted of cash held in escrow accounts mainly related to pending litigations and

construction activities.

Ahold's banking arrangements allow the Company to fund outstanding checks when presented to the bank for payment. This cash management practice may result in a net cash book overdraft position, which occurs when the

total issued checks exceed available cash balances within the Company's cash concentration structure. Such book overdrafts are classified in accounts payable and amounted to €216 million and €184 million as of January

3, 2016, and December 28, 2014, respectively. No right to offset with other bank balances exists for these book overdraft positions.

Authorized share capital comprises the following classes of shares as of January 3, 2016:

million

2015

2014

Common shares (2015: 1,171,000,000 at €0.01 par value each, and 2014: 1,700,000,000 of €0.01 par value each)

12

17

Cumulative preferred shares (2015: 30,000 of €500 par value each, and 2014: 43,520 of €500 par value each)

15

22

Total authorized share capital

27

39

In addition, Ahold has cumulative preferred financing shares outstanding. These cumulative preferred financing shares are considered debt under IFRS until the date that Ahold receives irrevocable notification from a holder

of cumulative preferred financing shares to convert these shares into common shares. Upon this notification, the cumulative preferred financing shares are classified as a separate class of equity since they no longer meet the

definition of a liability. For disclosures regarding Ahold's cumulative preferred financing shares, see Note 22.