Notes to the consolidated financial statements

103

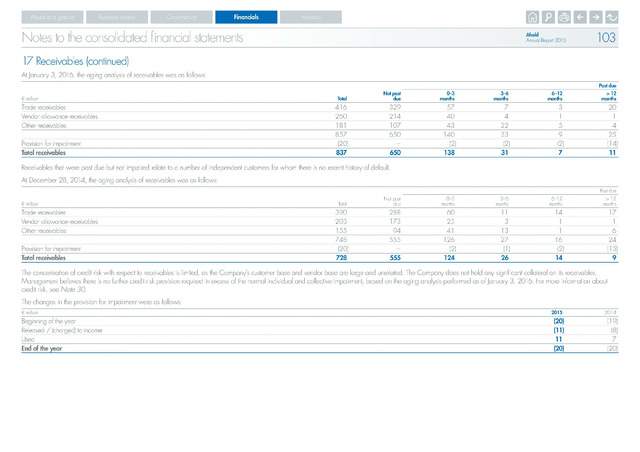

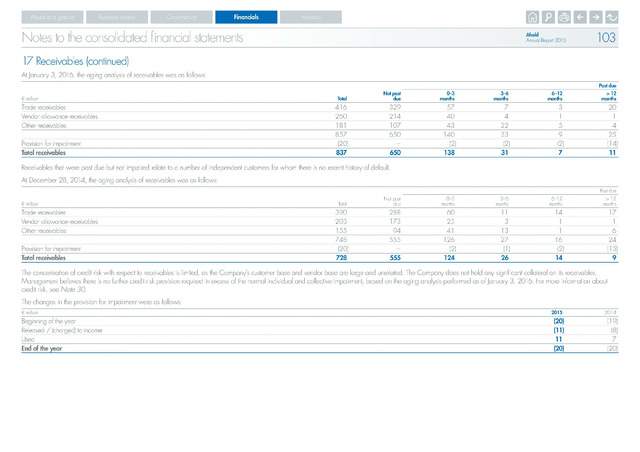

17 Receivables (continued)

Ahold at a glance

Business review

Governance

Financials

Ahold

Annual Report 2015

At January 3, 2016, the aging analysis of receivables was as follows:

Past due

millior

Total

Not past

due

0-3

months

3-6

months

6-12

months

12

months

Trade receivables

416

329

57

7

3

20

Vendor allowance receivables

260

214

40

4

1

1

Other receivables

181

107

43

22

5

4

857

650

140

33

9

25

Provision for impairment

(20)

(2)

(2)

(2)

(14)

Total receivables

837

650

138

31

7

11

Receivables that were past due but not impaired relate to a number of independent customers for whom there

is no recent history of default.

At December 28, 2014, the aging analysis of receivables was as follows:

Past due

million

Total

Not past

due

0-3

months

3-6

months

6-12

months

12

months

Trade receivables

390

288

60

11

14

17

Vendor allowance receivables

203

173

25

3

1

1

Other receivables

155

94

41

13

1

6

748

555

126

27

16

24

Provision for impairment

(20)

(2)

(1)

(2)

(15)

Total receivables

728

555

124

26

14

The concentration of credit risk with respect to receivables is limited, as the Company's customer base and vendor base are large and unrelated. The Company does not hold any significant collateral on its receivables.

Management believes there is no further credit risk provision required in excess of the normal individual and collective impairment, based on the aging analysis performed as of January 3, 2016. For more information about

credit risk, see Note 30.

The changes in the provision for impairment were as follows:

million

2015

2014

Beginning of the year

(20)

(19)

Released (charged) to income

(11)

(8)

Used

11

7

End of the year

(20)

(20)