Notes to the consolidated financial statements

129

31 Related party transactions (continued)

Ahold at a glance

Business review

Governance

Financials

Ahold

Annual Report 2015

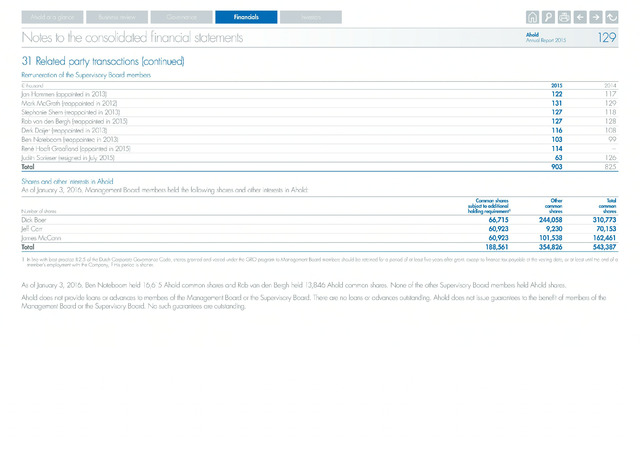

Remuneration of the Supervisory Board members

thousand

2015

2014

Jan Hommen (appointed in 2013)

122

117

Mark McGrath (reappointed in 2012)

131

129

Stephanie Shern (reappointed in 2013)

127

118

Rob van den Bergh (reappointed in 2015)

127

128

Derk Doijer (reappointed in 2013)

116

108

Ben Noteboom (reappointed in 2013)

103

99

René Hooft Graafland (appointed in 2015)

114

Judith Sprieser (resigned in July 2015)

63

126

Total

903

825

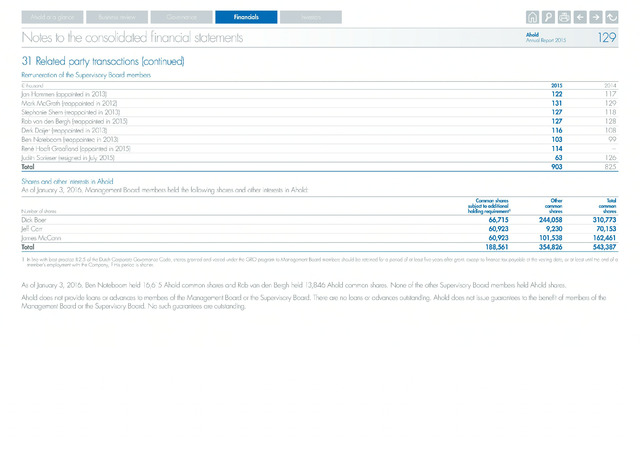

Shares and other interests in Ahold

As of January 3, 2016, Management Board members held the following shares and other interests in Ahold:

Number of shares

Common shares

subject to additional

holding requirement1

Other

common

shares

Total

common

shares

Dick Boer

66,715

244,058

310,773

Jeff Carr

60,923

9,230

70,153

James McCann

60,923

101,538

162,461

Total

188,561

354,826

543,387

1 In line with best practice II.2.5 of the Dutch Corporate Governance Code, shares granted and vested under the GRO program to Management Board members should be retained for a period of at least five years after grant, except to finance tax payable at the vesting date, or at least until the end of c

member's employment with the Company, if this period is shorter.

As of January 3, 2016, Ben Noteboom held 16,615 Ahold common shares and Rob van den Bergh held 13,846 Ahold common shares. None of the other Supervisory Board members held Ahold shares.

Ahold does not provide loans or advances to members of the Management Board or the Supervisory Board. There are no loans or advances outstanding. Ahold does not issue guarantees to the benefit of members of the

Management Board or the Supervisory Board. No such guarantees are outstanding.