Notes to the consolidated financial statements

92

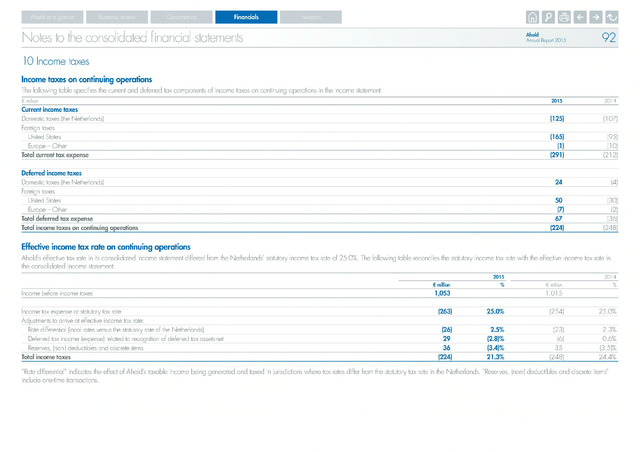

10 Income taxes

Income taxes on continuing operations

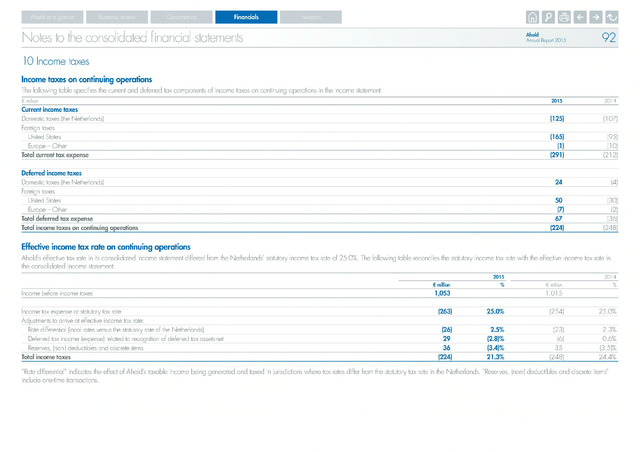

Effective income tax rate on continuing operations

,015

Ahold at a glance

Business review

Governance

Financials

Ahold

Annual Report 2015

The following table specifies the current and deferred tax components of income taxes on continuing operations in the income statement:

million

2015

2014

Current income taxes

Domestic taxes (the Netherlands)

(125)

(107)

Foreign taxes

United States

(165)

(95)

Europe - Other

(1)

(10)

Total current tax expense

(291)

(212)

Deferred income taxes

Domestic taxes (the Netherlands)

24

(4)

Foreign taxes

United States

50

(30)

Europe - Other

(7)

(2)

Total deferred tax expense

67

(36)

Total income taxes on continuing operations

(224)

(248)

Ahold's effective tax rate in its consolidated income statement differed from the Netherlands' statutory income tax rate of 25.0%. The following table reconciles the statutory income tax rate with the effective income tax rate in

the consolidated income statement:

2015

2014

million

1,053

Income before income taxes

Income tax expense at statutory tax rate (263) 25.0% (254) 25.0%

Adjustments to arrive at effective income tax rate:

Rate differential (local rates versus the statutory rate of the Netherlands)

(26)

2.5%

(23)

2.3%

Deferred tax income (expense) related to recognition of deferred tax assets-net

29

(2.8)%

(6)

0.6%

Reserves, (non-) deductibles and discrete items

36

(3.4)%

35

(3.5)%

Total income taxes

(224)

21.3%

(248)

24.4%

"Rate differential" indicates the effect of Ahold's taxable income being generated and taxed in jurisdictions where tax rates differ from the statutory tax rate in the Netherlands. "Reserves, (non-) deductibles and discrete items"

include one-time transactions.