BsimEiHHta

Group financial review (continued)

Liquidity and cash Hows

million

Ahold at a glance

Business review

Governance

Liquidity

Ahold relies on cash provided by operating activities

as a primary source of liquidity, in addition to debt

and equity issuances in the capital markets, credit

facilities and available cash balances. Based on our

current operating performance and liquidity position,

we believe that cash provided by operating activities

and available cash balances (including short-term

deposits and similar instruments) will be sufficient

for working capital, capital expenditure, planned

shareholder returns including dividend payments

and our new €500 million share buyback program,

interest payments, and scheduled debt repayment

requirements for the next 12 months and the

foreseeable future. A total of €30 million in loans will

mature in 2015, €0.4 billion in 2016 through 2019

and €1.0 billion after 2019.

As of year-end 2014, liquidity amounted to

€3.1 billion (2013: €5.0 billion), defined as cash

(including cash, cash equivalents and short-term

deposits and similar instruments) of €1.9 billion and

the undrawn portion of the committed credit facility

of €1.2 billion.

We continue to take a balanced approach between

investing in the business, repaying debt, and returning

cash to shareholders.

Under normal conditions we expect to operate with

liquidity of around €2.0 billion, evenly split between

cash and the undrawn portion of our committed

credit facilities. It is our intention to move to this level

of liquidity as we continue to invest in growth, reduce

our debt and return cash to shareholders, resulting in

a more efficient capital structure.

Group credit facility

Ahold has access to a €1.2 billion committed,

unsecured, multi-currency and syndicated credit

facility which was refinanced in June 2011. In June

2013, the full amount of the facility was extended

to June 2018. The facility may be used for working

capital and for general corporate purposes

and provides for the issuance of $550 million

(€400 million) in letters of credit. As of December 29,

2013, there were no outstanding borrowings under

the credit facility other than letters of credit to an

aggregate amount of $16 million (€13 million).

In the beginning of 2015, we issued a request to our

relationship banks to amend the facility by extending

it through 2020 and reducing the amount from

€1.2 billion down to €1 billion, which we expect to

be the undrawn amount. Ahold expects to close the

process during the first quarter of 2015.

Credit ratings

Maintaining investment grade credit ratings is a

cornerstone of our strategy as they serve to lower

the cost of funds and to facilitate access to a variety

of lenders and markets. S&P upgraded Ahold's

corporate credit rating to BBB with a stable outlook in

June 2009 and, since then, this rating has remained

unchanged. In July 2013, Moody's affirmed Ahold's

Baa3 issuer credit rating and changed its outlook to

positive from stable.

Cash hows

Free cash how, at €1,055 million, decreased by

€54 million compared to 2013. Operating cash

hows from continuing operations were down

€158 million, primarily as a result of higher income

tax paid. The purchase of non-current assets was

lower by €79 million.

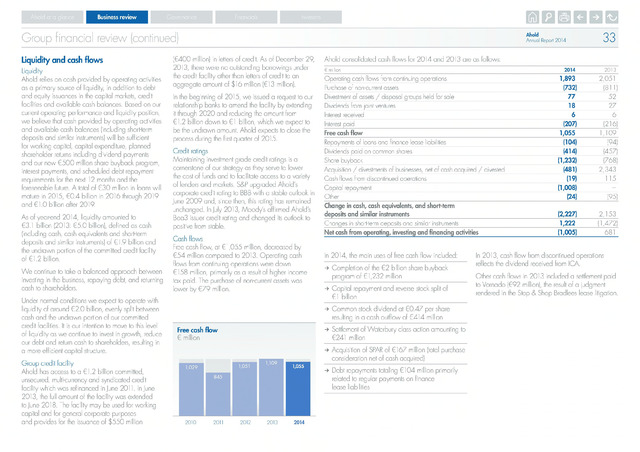

Free cash flow

1,109

1,029

1,051

1,055

845

201C

201"

2012

2013

2014

Ahold

Annual Report 2014

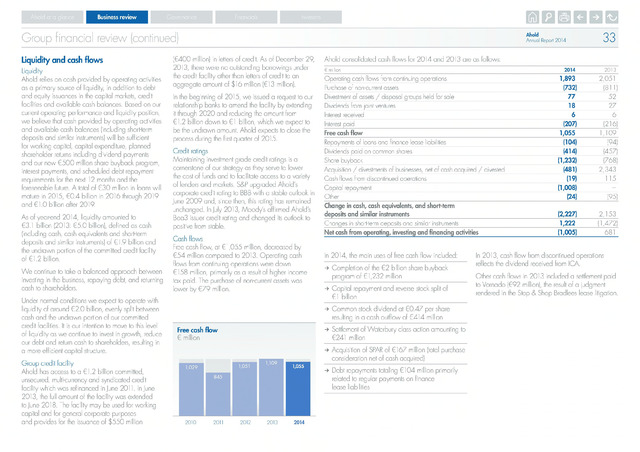

Ahold consolidated cash hows for 2014 and 2013 are as follows:

millior

2014

2013

Operating cash hows from continuing operations

1,893

2,051

Purchase of non-current assets

(732)

(811)

Divestment of assets disposal groups held for sale

77

52

Dividends from joint ventures

18

27

Interest received

6

6

Interest paid

(207)

(216)

Free cash flow

1,055

1,109

Repayments of loans and finance lease liabilities

(104)

(94)

Dividends paid on common shares

(414)

(457)

Share buyback

(1,232)

(768)

Acquisition divestments of businesses, net of cash acquired divested

(481)

2,343

Cash hows from discontinued operations

(19)

115

Capital repayment

(1,008)

Other

(24)

(95)

Change in cash, cash equivalents, and short-term

deposits and similar instruments

(2,227)

2,153

Changes in short-term deposits and similar instruments

1,222

(1,472)

Net cash from operating, investing and financing activities

(1,005)

681

In 2014, the main uses of free cash how included:

a Completion of the €2 billion share buyback

program of €1,232 million

a Capital repayment and reverse stock split of

€1 billion

a Common stock dividend at €0.47 per share

resulting in a cash outflow of €414 million

a Settlement of Waterbury class action amounting to

€241 million

a Acquisition of SPAR of €167 million (total purchase

consideration net of cash acquired)

a Debt repayments totaling €104 million primarily

related to regular payments on finance

lease liabilities

In 2013, cash how from discontinued operations

rehects the dividend received from ICA.

Other cash hows in 2013 included a settlement paid

to Vornado (€92 million), the result of a judgment

rendered in the Stop Shop Bradlees lease litigation.