BsimEiHHta

Group financial review (continued)

Results from operations

Ahold USA

The Netherlands

Ahold at a glance I Business review I Governance I Financials I Investors

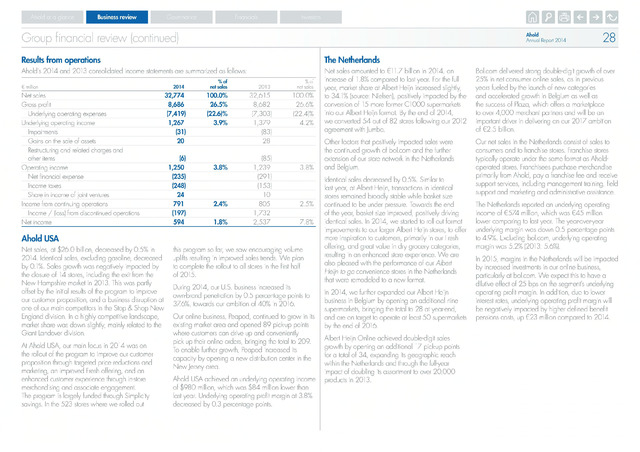

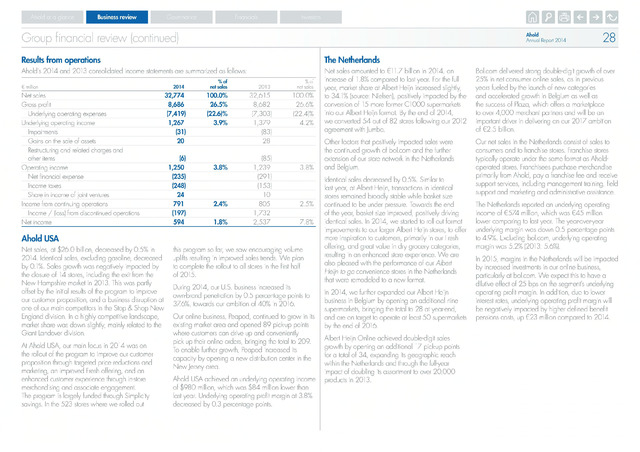

Ahold's 2014 and 2013 consolidated income statements are summarized as follows:

million

2014

of

net sales

2013

of

net sales

Net sales

32,774

100.0%

32,615

100.0%

Gross profit

8,686

26.5%

8,682

26.6%

Underlying operating expenses

(7,419)

(22.6)%

(7,303)

(22.4)%

Underlying operating income

1,267

3.9%

1,379

4.2%

Impairments

(31)

(83)

Gains on the sale of assets

20

28

Restructuring and related charges and

other items

(6)

(85)

Operating income

1,250

3.8%

1,239

3.8%

Net financial expense

(235)

(291)

Income taxes

(248)

(153)

Share in income of joint ventures

24

10

Income from continuing operations

791

2.4%

805

2.5%

Income (loss) from discontinued operations

(197)

1,732

Net income

594

1.8%

2,537

7.8%

Net sales, at $26.0 billion, decreased by 0.5% in

2014. Identical sales, excluding gasoline, decreased

by 0.1%. Sales growth was negatively impacted by

the closure of 14 stores, including the exit from the

New Hampshire market in 2013. This was partly

offset by the initial results of the program to improve

our customer proposition, and a business disruption at

one of our main competitors in the Stop Shop New

England division. In a highly competitive landscape,

market share was down slightly, mainly related to the

Giant Landover division.

At Ahold USA, our main focus in 2014 was on

the rollout of the program to improve our customer

proposition through targeted price reductions and

marketing, an improved Fresh offering, and an

enhanced customer experience through in-store

merchandising and associate engagement.

The program is largely funded through Simplicity

savings. In the 523 stores where we rolled out

this program so far, we saw encouraging volume

uplifts resulting in improved sales trends. We plan

to complete the rollout to all stores in the first half

of 2015.

During 2014, our U.S. business increased its

own-brand penetration by 0.5 percentage points to

37.6%, towards our ambition of 40% in 2016.

Our online business, Peapod, continued to grow in its

existing market area and opened 89 pick-up points

where customers can drive up and conveniently

pick up their online orders, bringing the total to 209,

To enable further growth, Peapod increased its

capacity by opening a new distribution center in the

New Jersey area.

Ahold USA achieved an underlying operating income

of $980 million, which was $84 million lower than

last year. Underlying operating profit margin at 3.8%

decreased by 0.3 percentage points.

Net sales amounted to €11.7 billion in 2014, an

increase of 1.8% compared to last year. For the full

year, market share at Albert Heijn increased slightly,

to 34.1% (source: Nielsen), positively impacted by the

conversion of 15 more former C1000 supermarkets

into our Albert Heijn format. By the end of 2014,

we converted 54 out of 82 stores following our 2012

agreement with Jumbo.

Other factors that positively impacted sales were

the continued growth of bol.com and the further

extension of our store network in the Netherlands

and Belgium.

Identical sales decreased by 0.5%. Similar to

last year, at Albert Heijn, transactions in identical

stores remained broadly stable while basket size

continued to be under pressure. Towards the end

of the year, basket size improved, positively driving

identical sales. In 2014, we started to roll out format

improvements to our larger Albert Heijn stores, to offer

more inspiration to customers, primarily in our Fresh

offering, and great value in dry grocery categories,

resulting in an enhanced store experience. We are

also pleased with the performance of our Albert

Heijn to go convenience stores in the Netherlands

that were remodeled to a new format.

In 2014, we further expanded our Albert Heijn

business in Belgium by opening an additional nine

supermarkets, bringing the total to 28 at year-end,

and are on target to operate at least 50 supermarkets

by the end of 2016.

Albert Heijn Online achieved double-digit sales

growth by opening an additional 17 pick-up points

for a total of 34, expanding its geographic reach

within the Netherlands and through the full-year

impact of doubling its assortment to over 20,000

products in 2013.

Ahold

Annual Report 2014

Bol.com delivered strong double-digit growth of over

25% in net consumer online sales, as in previous

years fueled by the launch of new categories

and accelerated growth in Belgium as well as

the success of Plaza, which offers a marketplace

to over 4,000 merchant partners and will be an

important driver in delivering on our 2017 ambition

of €2.5 billion.

Our net sales in the Netherlands consist of sales to

consumers and to franchise stores. Franchise stores

typically operate under the same format as Ahold-

operated stores. Franchisees purchase merchandise

primarily from Ahold, pay a franchise fee and receive

support services, including management training, field

support and marketing and administrative assistance.

The Netherlands reported an underlying operating

income of €574 million, which was €45 million

lower comparing to last year. The year-over-year

underlying margin was down 0.5 percentage points

to 4.9%. Excluding bol.com, underlying operating

margin was 5.2% (2013: 5.6%).

In 2015, margins in the Netherlands will be impacted

by increased investments in our online business,

particularly at bol.com. We expect this to have a

dilutive effect of 25 bps on the segment's underlying

operating profit margin. In addition, due to lower

interest rates, underlying operating profit margin will

be negatively impacted by higher defined benefit

pensions costs, up €23 million compared to 2014.