Notes to the parent company financial statements

148

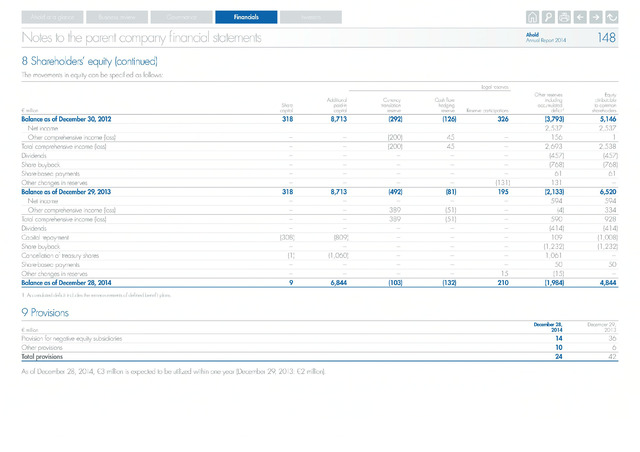

8 Shareholders' equity (continued)

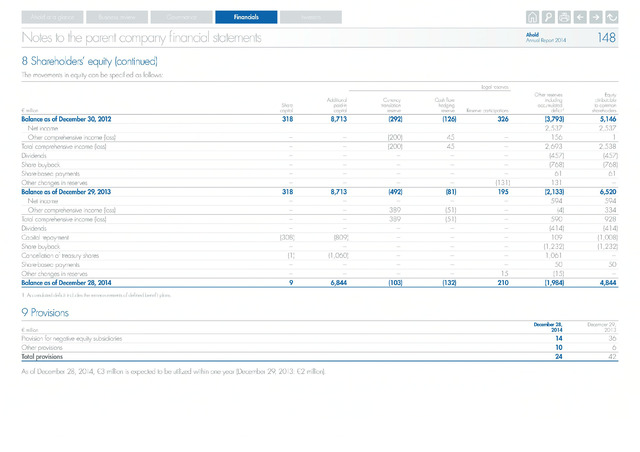

9 Provisions

Ahold at a glance

Business review

Governance

Financials

Ahold

Annual Report 2014

The movements in equity can be specified as follows:

million

Share

capital

Additional

paid-in

capital

Currency

translation

reserve

Cash how

hedging

reserve

Reserve participations

Other reserves

including

accumulated

deficit1

Equity

attributable

to common

shareholders

Balance as of December 30, 2012

318

8,713

(292)

(126)

326

(3,793)

5,146

Net income

2,537

2,537

Other comprehensive income (loss)

(200)

45

156

1

Total comprehensive income (loss)

(200)

45

2,693

2,538

Dividends

(457)

(457)

Share buyback

(768)

(768)

Share-based payments

61

61

Other changes in reserves

(131)

131

Balance as of December 29, 2013

318

8,713

(492)

(81)

195

(2,133)

6,520

Net income

594

594

Other comprehensive income (loss)

389

(51)

(4)

334

Total comprehensive income (loss)

389

(51)

590

928

Dividends

(414)

(414)

Capital repayment

(308)

(809)

109

(1,008)

Share buyback

(1,232)

(1,232)

Cancellation of treasury shares

(1)

(1,060)

1,061

Share-based payments

50

50

Other changes in reserves

15

(15)

Balance as of December 28, 2014

9

6,844

(103)

(132)

210

(1,984)

4,844

1 Accumulated deficit includes the remeasurements of defined benefit plans.

million

December 28,

2014

December 29,

2013

Provision for negative equity subsidiaries

14

36

Other provisions

10

6

Total provisions

24

42

As of December 28, 2014, €3 million is expected to be utilized within one year (December 29, 2013: €2 million).