Notes to the consolidated financial statements

136

34 Commitments and contingencies (continued)

Ahold at a glance

Business review

Governance

Financials

Ahold

Annual Report 2014

Ahold is contingently liable for leases that have been assigned to third parties in connection with facility closings and asset disposals. Ahold could be required to assume the financial obligations under these leases if any

of the assignees are unable to fulfil their lease obligations. The lease guarantees are based on the nominal value of future minimum lease payments of the assigned leases, which extend through 2040. The amounts of the

lease guarantees exclude the cost of common area maintenance and real estate taxes; such amounts may vary in time, per region, and per property. Of the €499 million in the undiscounted lease guarantees, €221 million

relates to the BI-LO Bruno's divestment and €173 million to the Tops divestment. On a discounted basis the lease guarantees amount to €434 million and €424 million as of December 28, 2014, and December 29, 2013,

respectively.

On February 5, 2009, and March 23, 2009, Bruno's Supermarkets, LLC and BI-LO, LLC, respectively, fled for protection under Chapter 11 of the U.S. Bankruptcy Code (the flings). As a result of the flings, Ahold has made

an assessment of its potential obligations under the lease guarantees based upon the remaining initial term of each lease, an assessment of the possibility that Ahold would have to pay under a guarantee and any potential

remedies that Ahold may have to limit future lease payments. Consequently, in 2009, Ahold recognized provisions of €109 million and related tax benefit offsets of €47 million within results on divestments.

On May 12, 2010, the reorganized BI-LO exited bankruptcy protection and BI-LO assumed 149 operating locations that are guaranteed by Ahold. During the BI-LO bankruptcy, BI-LO rejected a total of 16 leases which are

guaranteed by Ahold and Ahold also took assignment of 12 other BI-LO leases with Ahold guarantees. Based on the foregoing developments, Ahold recognized a reduction of €23 million in its provision, after tax, within

results on divestments in the first half of 2010. Since the end of the second quarter of 2010, Ahold has entered into settlements with a number of landlords relating to leases of former BI-LO or Bruno's stores that are guaranteed

by Ahold.

At the end of 2014, the remaining provision relating to BI-LO and Bruno's was €24 million (2013: €25 million) with a related tax benefit offset of €10 million (2013: €11 million). This amount represents Ahold's best estimate of

the discounted aggregate amount of the remaining lease obligations and associated charges, net of known mitigation offsets, which could result in cash outflows for Ahold under the various lease guarantees. Ahold continues

to monitor any developments and pursue its mitigation efforts with respect to these lease guarantee liabilities.

Ahold has provided corporate guarantees to certain suppliers of Ahold's franchisees or non-consolidated entities. Ahold would be required to perform under the guarantee if the franchisee or non-consolidated entity failed to

meet its financial obligations, as described in the guarantee. Buyback guarantees relate to Ahold's commitment to repurchase stores or inventory from certain franchisees at predetermined prices. The buyback guarantees refect

the maximum committed repurchase value under the guarantees. The last of the corporate and buyback guarantees expire in 2023.

Loan guarantees relate to the principal amounts of certain loans payable by Ahold's franchisees, non-consolidated real estate development entities and joint ventures. The term of most guarantees is equal to the term of the

related loan, the last of which matures in 2016. Ahold's maximum liability under the guarantees equals the total amount of the related loans plus, in most cases, reasonable costs of enforcement of the guarantee.

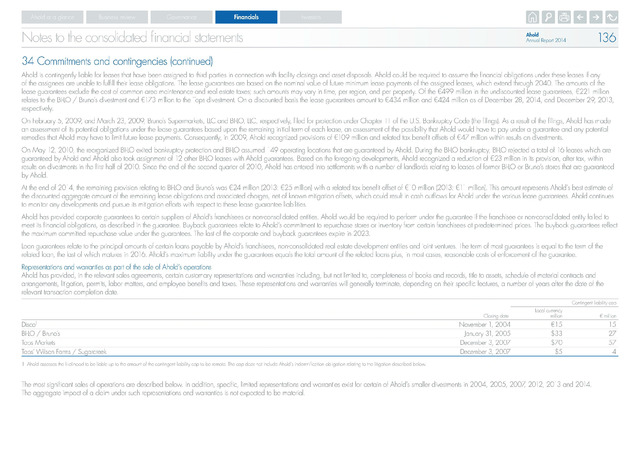

Representations and warranties as part of the sale of Ahold's operations

Ahold has provided, in the relevant sales agreements, certain customary representations and warranties including, but not limited to, completeness of books and records, title to assets, schedule of material contracts and

arrangements, litigation, permits, labor matters, and employee benefits and taxes. These representations and warranties will generally terminate, depending on their specific features, a number of years after the date of the

relevant transaction completion date.

Closing date

Local currency

million

Contingent liability cap

million

Disco1

November 1, 2004

€15

15

BI-LO Bruno's

January 31, 2005

$33

27

Tops Markets

December 3, 2007

$70

57

Tops' Wilson Farms Sugarcreek

December 3, 2007

$5

4

Ahold C

likelihood to be liable up to the amount of the contingent liability cap to be remote. The cap does not include Ahold's indemnification obligation relating to the litigation described below.

The most significant sales of operations are described below. In addition, specific, limited representations and warranties exist for certain of Ahold's smaller divestments in 2004, 2005, 2007 2012, 2013 and 2014.

The aggregate impact of a claim under such representations and warranties is not expected to be material.