BsimEiHHta

49

Supervisory Board report (continued)

Remuneration

Committees of the Supervisory Board

a Ahold's finance structure

Ahold at a glance I Business review I Governance I Financials I Investors

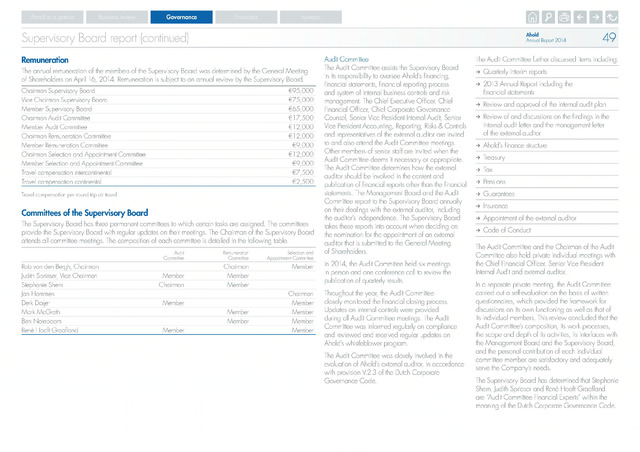

The annual remuneration of the members of the Supervisory Board was determined by the General Meeting

of Shareholders on April 16, 2014. Remuneration is subject to an annual review by the Supervisory Board.

Chairman Supervisory Board

€95,000

Vice Chairman Supervisory Board

€75,000

Member Supervisory Board

€65,000

Chairman Audit Committee

€17,500

Member Audit Committee

€12,000

Chairman Remuneration Committee

€12,000

Member Remuneration Committee

€9,000

Chairman Selection and Appointment Committee

€12,000

Member Selection and Appointment Committee

€9,000

Travel compensation intercontinental

€7,500

Travel compensation continental

€2,500

Travel compensation per round trip air travel.

The Supervisory Board has three permanent committees to which certain tasks are assigned. The committees

provide the Supervisory Board with regular updates on their meetings. The Chairman of the Supervisory Board

attends all committee meetings. The composition of each committee is detailed in the following table.

Audit

Committee

Remuneration

Committee

Selection anc

Appointment Committee

Rob van den Bergh, Chairman

Chairman

Member

Judith Sprieser, Vice Chairman

Member

Member

Stephanie Shern

Chairman

Member

Jan Hommen

Chairman

Derk Doijer

Member

Member

Mark McGrath

Member

Member

Ben Noteboom

Member

Member

René Hooft Graafland

Member

Member

Ahold

Annual Report 2014

Audit Committee

The Audit Committee assists the Supervisory Board

in its responsibility to oversee Ahold's financing,

financial statements, financial reporting process

and system of internal business controls and risk

management. The Chief Executive Officer, Chief

Financial Officer, Chief Corporate Governance

Counsel, Senior Vice President Internal Audit, Senior

Vice President Accounting, Reporting, Risks Controls

and representatives of the external auditor are invited

to and also attend the Audit Committee meetings.

Other members of senior staff are invited when the

Audit Committee deems it necessary or appropriate.

The Audit Committee determines how the external

auditor should be involved in the content and

publication of financial reports other than the financial

statements. The Management Board and the Audit

Committee report to the Supervisory Board annually

on their dealings with the external auditor, including

the auditor's independence. The Supervisory Board

takes these reports into account when deciding on

the nomination for the appointment of an external

auditor that is submitted to the General Meeting

of Shareholders.

In 2014, the Audit Committee held six meetings

in person and one conference call to review the

publication of quarterly results.

Throughout the year, the Audit Committee

closely monitored the financial closing process.

Updates on internal controls were provided

during all Audit Committee meetings. The Audit

Committee was informed regularly on compliance

and reviewed and received regular updates on

Ahold's whistleblower program.

The Audit Committee was closely involved in the

evaluation of Ahold's external auditor, in accordance

with provision V.2.3 of the Dutch Corporate

Governance Code.

The Audit Committee further discussed items including:

a Quarterly interim reports

a 2013 Annual Report including the

financial statements

a Review and approval of the internal audit plan

a Review of and discussions on the findings in the

internal audit letter and the management letter

of the external auditor

a Treasury

a Tax

a Pensions

a Guarantees

a Insurance

a Appointment of the external auditor

a Code of Conduct

The Audit Committee and the Chairman of the Audit

Committee also held private individual meetings with

the Chief Financial Officer, Senior Vice President

Internal Audit and external auditor.

In a separate private meeting, the Audit Committee

carried out a self-evaluation on the basis of written

questionnaires, which provided the framework for

discussions on its own functioning as well as that of

its individual members. This review concluded that the

Audit Committee's composition, its work processes,

the scope and depth of its activities, its interfaces with

the Management Board and the Supervisory Board,

and the personal contribution of each individual

committee member are satisfactory and adequately

serve the Company's needs.

The Supervisory Board has determined that Stephanie

Shern, Judith Sprieser and René Hooft Graafland

are "Audit Committee Financial Experts" within the

meaning of the Dutch Corporate Governance Code.