H

178

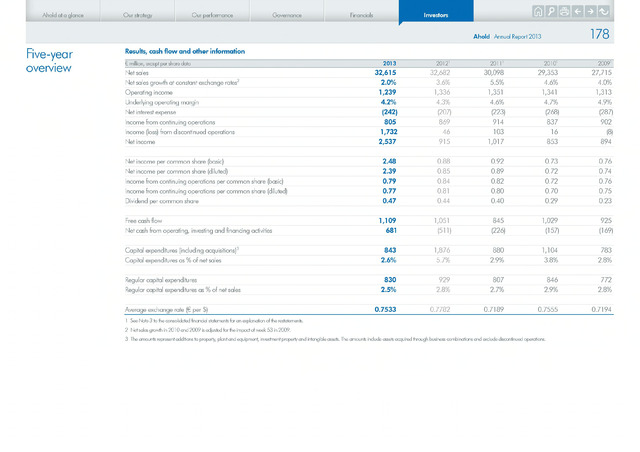

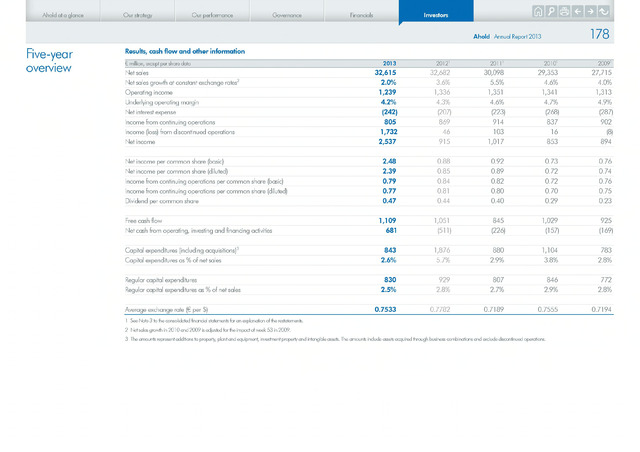

Five-year

overview

Ahold at a glance

Our strategy

Our performance

Governan

Finan

Results, cash flow and other information

million, except per share data

Net sales

Net sales growth at constant exchange rates2

Operating income

Underlying operating margin

Net interest expense

Income from continuing operations

Income (loss) from discontinued operations

Net income

nvestors

Ahold Annual Report 2013

2013

2012'

2011'

32,615

2.0%

1,239

4.2%

(242)

805

1,732

2,537

32,682

3.6%

1,336

4.3%

(207)

869

46

915

30,098

5.5%

1,351

4.6%

(223)

914

103

1,017

20101

29,353

4.6%

1,341

4.7%

(268)

837

16

853

20091

27,715

4.0%

1,313

4.9%

(287)

902

(8)

894

Net income per common share (basic) 2.48 0.88 0.92 0.73 0.76

Net income per common share (diluted)

2.39

0.85

0.89

0.72

0.74

Income from continuing operations per common share (basic)

0.79

0.84

0.82

0.72

0.76

Income from continuing operations per common share (diluted)

0.77

0.81

0.80

0.70

0.75

Dividend per common share 0.47 0.44 0.40 0.29 0.23

Free cash flow 1,109 1,051 845 1,029 925

Net cash from operating, investing and financing activities

681

(511)

(226)

(157)

(169)

Capital expenditures (including acquisitions)3

843

1,876

880

1,104

783

Capital expenditures as of net sales

2.6%

5.7%

2.9%

3.8%

2.8%

Regular capital expenditures

830

929

807

846

772

Regular capital expenditures as of net sales 2.5% 2.8% 2.7% 2.9% 2.8%

Average exchange rate per 0.7533 0.7782 0.7189 0.7555 0.7194

1 See Note 3 to the consolidated financial statements for an explanation of the restatements.

2 Net sales growth in 2010 and 2009 is adjusted for the impact of week 53 in 2009.

3 The amounts represent additions to property, plant and equipment, investment property and intangible assets. The amounts include assets acquired through business combinations and exclude discontinued operations.