H

120

22 Other non-current financial liabilities (continued)

Ahold at a glance

Our strategy

Our performance

Governan

Financials

Investors

Notes to the consolidated

financial statements

Ahold Annual Report 2013

During 2013, interest expense on finance lease liabilities was €95 million (2012: €102 million), of which €2 million related to discontinued operations (2012 as restated: €4 million). Total

future minimum sublease income expected to be received under non-cancelable subleases as of December 29, 2013, is €116 million (December 30, 2012: €140 million). The total

contingent rent expense recognized during the year on finance leases was €4 million (2012: €1 million).

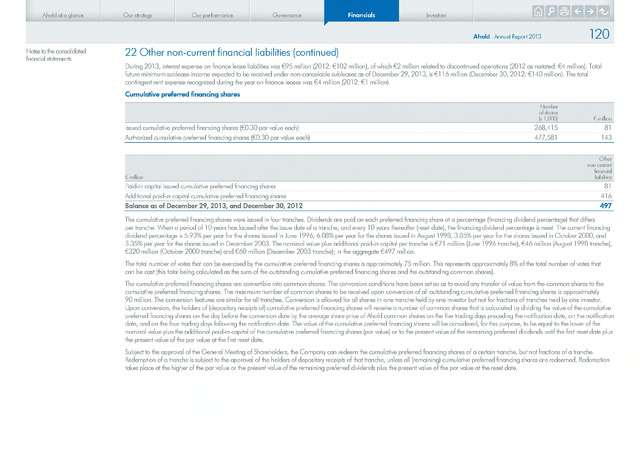

Cumulative preferred financing shares

Number

of shares

(x 1,000)

million

Issued cumulative preferred financing shares (€0.30 par value each)

268,415

81

Authorized cumulative preferred financing shares (€0.30 par value each)

477,581

143

Other

non-current

financial

million

liabilities

Paid-in capital issued cumulative preferred financing shares

81

Additional paid-in capital cumulative preferred financing shares 416

Balance as of December 29, 2013, and December 30, 2012 497

The cumulative preferred financing shares were issued in four tranches. Dividends are paid on each preferred financing share at a percentage (financing dividend percentage) that differs

per tranche. When a period of 10 years has lapsed after the issue date of a tranche, and every 10 years thereafter (reset date), the financing dividend percentage is reset. The current financing

dividend percentage is 5.93% per year for the shares issued in June 1 996, 6.08% per year for the shares issued in August 1998, 3.85% per year for the shares issued in October 2000, and

3.35% per year for the shares issued in December 2003. The nominal value plus additional paid-in capital per tranche is €71 million (June 1996 tranche), €46 million (August 1998 tranche),

€320 million (October 2000 tranche) and €60 million (December 2003 tranche); in the aggregate €497 million.

The total number of votes that can be exercised by the cumulative preferred financing shares is approximately 75 million. This represents approximately 8% of the total number of votes that

can be cast (this total being calculated as the sum of the outstanding cumulative preferred financing shares and the outstanding common shares).

The cumulative preferred financing shares are convertible into common shares. The conversion conditions have been set so as to avoid any transfer of value from the common shares to the

cumulative preferred financing shares. The maximum number of common shares to be received upon conversion of all outstanding cumulative preferred financing shares is approximately

90 million. The conversion features are similar for all tranches. Conversion is allowed for all shares in one tranche held by one investor but not for fractions of tranches held by one investor.

Upon conversion, the holders of (depositary receipts of) cumulative preferred financing shares will receive a number of common shares that is calculated by dividing the value of the cumulative

preferred financing shares on the day before the conversion date by the average share price of Ahold common shares on the five trading days preceding the notification date, on the notification

date, and on the four trading days following the notification date. The value of the cumulative preferred financing shares will be considered, for this purpose, to be equal to the lower of the

nominal value plus the additional paid-in capital of the cumulative preferred financing shares (par value) or to the present value of the remaining preferred dividends until the first reset date plus

the present value of the par value at the first reset date.

Subject to the approval of the General Meeting of Shareholders, the Company can redeem the cumulative preferred financing shares of a certain tranche, but not fractions of a tranche.

Redemption of a tranche is subject to the approval of the holders of depositary receipts of that tranche, unless all (remaining) cumulative preferred financing shares are redeemed. Redemption

takes place at the higher of the par value or the present value of the remaining preferred dividends plus the present value of the par value at the reset date.