H

HaEl

□I

37

Financial review

Net sales

Ahold at a glance Our strategy

Our performance

Governan

Financials

Investors

Ahold Annual Report 2013

Net sales in 2013 were €32.6 billion, down 0.2%

compared to 2012. At constant exchange rates, net

sales growth was 2.0%. We delivered sales growth

in both the United States and the Netherlands,

despite market conditions that remained

challenging. The Czech Republic reported negative

sales growth. We managed to grow our market

share in the United States and the Netherlands,

and maintained our share in the Czech Republic.

Our net sales grew due to identical sales growth,

store remodeling and expansion, new store

openings, and the impact of the full-year's sales

from our acquisitions made during 2012 (bol.com,

15 Genuardi's stores in the United States and 39

stores in the Netherlands that were converted after

the agreement to transfer 82 stores from Jumbo).

Both our grocery and non-food online businesses

continued to grow by double-digits. Our online

businesses contributed over 3% to Ahold's net sales

in 2013.

Our net sales consist of sales to consumers and

to franchise stores. Franchise stores typically

operate under the same format as Ahold-operated

stores. Franchisees purchase merchandise

primarily from Ahold, pay a franchise fee and

receive support services, including management

training, field support and marketing and

administrative assistance.

Ahold USA

Net sales, at $26.1 billion, increased by 1.1% in

2013. Identical sales, excluding gasoline, increased

by 0.3%. In challenging market conditions,

Ahold USA achieved market share gains in both

the supermarket and the all outlet channels.

Sales growth benefitted primarily from acquired

and new stores, and effective loyalty programs.

A negative impact resulted from Hurricane Sandy,

which increased sales during the last quarter of

2012, and the closure of 14 stores including the

exit from the New Hampshire market. Our online

business Peapod continued to grow in its existing

market area, launched virtual grocery stores and

opened 112 pick-up points where customers can

drive up and conveniently pick up their online

orders, bringing the total to 120.

The Netherlands

Net sales amounted to €11.5 billion in 2013,

an increase of 4.0% compared to last year.

Identical sales increased by 0.6%. For the full year,

market share at Albert Heijn increased slightly, to

33.8%, positively impacted by the conversion of

24 former C1000 supermarkets. Other factors

that positively impacted sales growth were the

continued growth of bol.com and the opening of

additional supermarkets in Belgium. At Albert Heijn,

transactions in identical stores remained broadly

stable while basket size continued to be under

pressure. Albert Heijn online achieved double-digit

sales growth by opening an additional 14 pick-up

points, expanding its geographical reach within the

Netherlands and doubling its assortment to over

20,000 products.

Czech Republic

Net sales amounted to €1.4 billion in 2013, a

decrease of 4.7%, or 1.5% at constant exchange

rates. Albert again ran successful consumer

campaigns, including one that was related to the

Smurfs movie. Identical sales excluding gasoline

decreased by 1.5% as the market remained under

pressure, significantly impacted by increases in the

value-added tax rates in 2012 and 2013, which

negatively affected consumer buying power. Still,

as in the previous year, Albert performed well

compared with its competitors and succeeded in

maintaining market share, despite its share of stores

declining due to competitive openings.

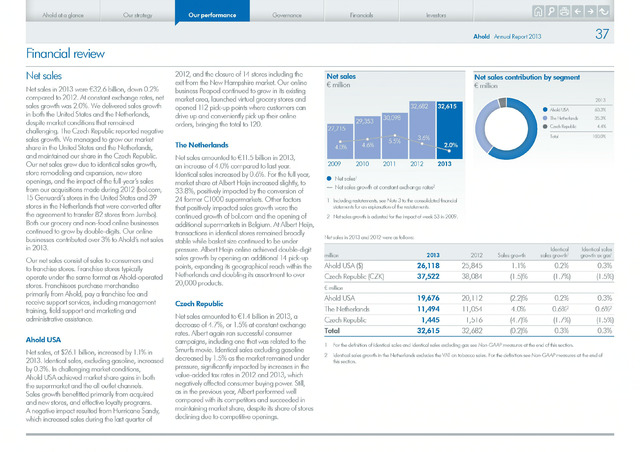

Net sales

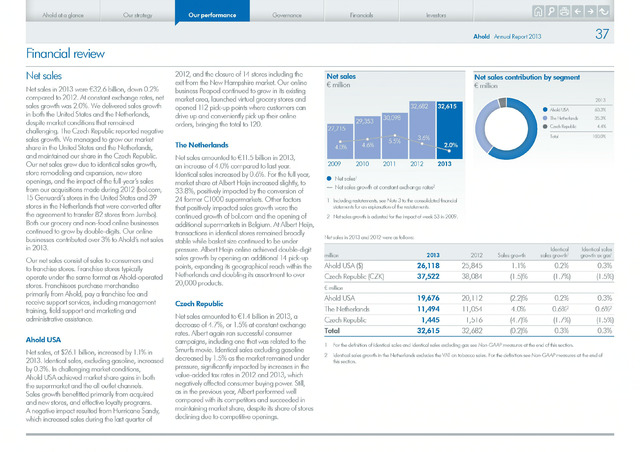

Net sales contribution by segment

32,682

32,615

30,098

29,353^

27,715

5.5%

3.6%

4.0%

2.0%

4.6%

Ahold USA

The Netherlands

Czech Republic

Total

2009

2010

2011

2012

2013

Net sales1

Net sales growth at constant exchange rates2

1 Including restatements, see Note 3 to the consolidated financial

statements for an explanation of the restatements.

2 Net sales growth is adjusted for the impact cf week 53 in 2009.

Net sales in 2013 and 2012 were as follows:

million

2013

2012

Sales growth

Identical

sales growth1

Identical sales

growth ex gas1

Ahold USA

26,118

25,845

1.1%

0.2%

0.3%

Czech Republic (CZK)

37,522

38,084

(1.5)%

(1.7%)

(1.5%)

million

Ahold USA

19,676

20,112

(2.2)%

0.2%

0.3%

The Netherlands

11,494

11,054

4.0%

0.6%2

0.6%2

Czech Republic

1,445

1,516

(4.7)%

(1.7%)

(1.5%)

Total

32,615

32,682

(0.2)%

0.3%

0.3%

1 For the definition of identical sales and identical sales excluding gas see Non-GAAP measures at the end of this section.

2 Identical sales growth in the Netherlands excludes the VAT on tobacco sales. For the definition see Non-GAAP measures at the end of

this section.