O www.ahold.com/reports2009

Notes to the consolidated financial statements

30 Financial risk management and financial instruments - continued

2,863

-

-

(1,043)

Financials

Capital risk management

The Company's primary objective in terms of managing capital is the optimization of its debt and equity balances in order to sustain the

future development of the business, maintain an investment grade credit rating and maximize shareholder value.

The capital structure of the Company consists of net debt, which includes borrowings, cash, cash equivalents and short-term deposits

(see Notes 18, 19, 21, 22 and 26), and equity (see Note 20). Ahold may balance its overall capital structure in a number of ways,

including through the payment of dividends, capital reduction, new share issues and share buybacks as well as the issuance of new debt

or the redemption of existing debt.

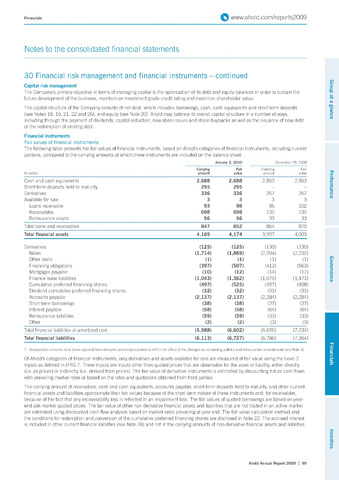

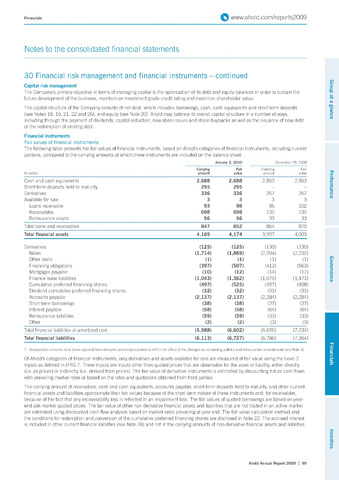

Financial instruments

Fair values of financial instruments

The following table presents the fair values of financial instruments, based on Ahold's categories of financial instruments, including current

portions, compared to the carrying amounts at which these instruments are included on the balance sheet:

January 3, 2010

December 28, 20081

Carrying

Fair

Carrying

Fair

million

amount

value

amount

value

Cash and cash equivalents

2,688

2,688

2,863

Short-term deposits held to maturity

295

295

Derivatives

336

336

267

267

Available for sale

3

3

3

3

Loans receivable

93

98

96

102

Receivables

698

698

735

735

Reinsurance assets

56

56

33

33

Total loans and receivables

847

852

864

870

Total financial assets

4,169

4,174

3,997

4,003

Derivatives

(125)

(125)

(130)

(130)

Notes

(1,714)

(1,869)

(2,204)

(2,232)

Other loans

(1)

(1)

(1)

(1)

Financing obligations

(397)

(507)

(413)

(563)

Mortgages payable

(10)

(12)

(14)

(17)

Finance lease liabilities

(1,362)

(1,075)

(1,471)

Cumulative preferred financing shares

(497)

(525)

(497)

(498)

Dividend cumulative preferred financing shares

(32)

(32)

(31)

(31)

Accounts payable

(2,137)

(2,137)

(2,284)

(2,284)

Short-term borrowings

(38)

(38)

(37)

(37)

Interest payable

(58)

(58)

(64)

(64)

Reinsurance liabilities

(59)

(59)

(33)

(33)

Other

(2)

(2)

(3)

(3)

Total financial liabilities at amortized cost

(5,988)

(6,602)

(6,656)

(7,234)

Total financial liabilities

(6,113)

(6,727)

(6,786)

(7,364)

1 Comparative amounts have been adjusted from amounts previously reported to reflect the effect of the changes in accounting policies and retrospective amendments (see Note 3).

Of Ahold's categories of financial instruments, only derivatives and assets available for sale are measured at fair value using the Level 2

inputs as defined in IFRS 7. These inputs are inputs other than quoted prices that are observable for the asset or liability, either directly

(i.e. as prices) or indirectly (i.e. derived from prices). The fair value of derivative instruments is estimated by discounting future cash flows

with prevailing market rates or based on the rates and quotations obtained from third parties.

The carrying amount of receivables, cash and cash equivalents, accounts payable, short-term deposits held to maturity, and other current

financial assets and liabilities approximate their fair values because of the short-term nature of these instruments and, for receivables,

because of the fact that any recoverability loss is reflected in an impairment loss. The fair values of quoted borrowings are based on year-

end ask-market quoted prices. The fair value of other non-derivative financial assets and liabilities that are not traded in an active market

are estimated using discounted cash flow analyses based on market rates prevailing at year end. The fair value calculation method and

the conditions for redemption and conversion of the cumulative preferred financing shares are disclosed in Note 22. The accrued interest

is included in other current financial liabilities (see Note 26) and not in the carrying amounts of non-derivative financial assets and liabilities.

Ahold Annual Report 2009 99