O

Notes to the consolidated financial statements

31 Share-based compensation continued

69,848

70,536

159,284

12,386

22,398

84,278

59,974

48,452

101,134

A.D. Boer

57,926

79,558

105,348

5,079,536 - 142,294

3,722,980 - 47,392

- 4,589,770 11,821

242,238 4,695,004

261,354 3,414,234

194,231 4,383,718

9,223,594 5,039,814

201,507

697,823 13,364,078

Other conditional shares

Financial statements

AHOLD ANNUAL REPORT 2008 98

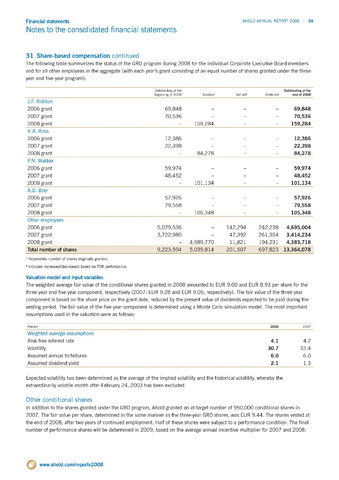

The following table summarizes the status of the GRO program during 2008 for the individual Corporate Executive Board members

and for all other employees in the aggregate (with each year's grant consisting of an equal number of shares granted under the three-

year and five-year program):

Outstanding at the Outstanding at the

beginning of 20081 Granted1 Settled2 Forfeited end of 20081

J.F. Rishton

2006 grant

2007 grant

2008 grant

69,848

70,536

159,284

K.A. Ross

2006 grant

2007 grant

2008 grant

12,386

22,398

84,278

P.N. Wakkie

2006 grant

2007 grant

2008 grant

59,974

48,452

101,134

2006 grant

2007 grant

2008 grant

57,926

79,558

105,348

Other employees

2006 grant

2007 grant

2008 grant

Total number of shares

1 Represents number of shares originally granted.

2 Includes increases/(decreases) based on TSR performance.

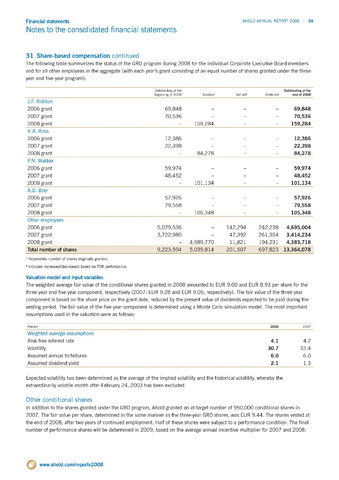

Valuation model and input variables

The weighted average fair value of the conditional shares granted in 2008 amounted to EUR 9.00 and EUR 8.93 per share for the

three-year and five-year component, respectively (2007: EUR 9.28 and EUR 9.05, respectively). The fair value of the three-year

component is based on the share price on the grant date, reduced by the present value of dividends expected to be paid during the

vesting period. The fair value of the five-year component is determined using a Monte Carlo simulation model. The most important

assumptions used in the valuation were as follows:

Percent

2008

2007

Weighted average assumptions

Risk-free interest rate

4.1

4.2

Volatility

30.7

32.4

Assumed annual forfeitures

6.0

6.0

Assumed dividend yield

2.1

CO

1—1

Expected volatility has been determined as the average of the implied volatility and the historical volatility, whereby the

extraordinarily volatile month after February 24, 2003 has been excluded.

In addition to the shares granted under the GRO program, Ahold granted an at-target number of 950,000 conditional shares in

2007. The fair value per share, determined in the same manner as the three-year GRO shares, was EUR 9.44. The shares vested at

the end of 2008, after two years of continued employment. Half of these shares were subject to a performance condition. The final

number of performance shares will be determined in 2009, based on the average annual incentive multiplier for 2007 and 2008.

www.ahold.com/reports2008