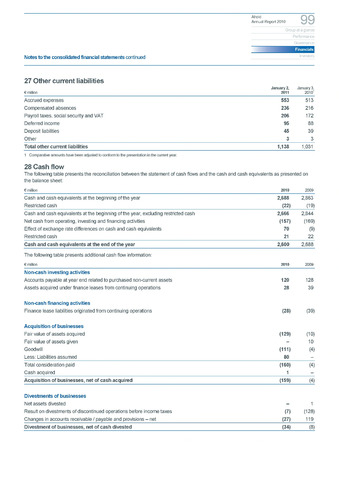

27 Other current liabilities

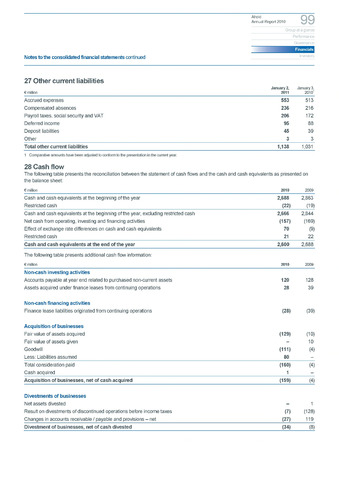

28 Cash flow

-

-

-

-

Ahold

Annual Report 2010

Group at a glance

Performance

Governance

Financials

Notes to the consolidated financial statements continued

Investors

January 2,

January 3,

million

2011

20101

Accrued expenses

553

513

Compensated absences

236

216

Payroll taxes, social security and VAT

206

172

Deferred income

95

88

Deposit liabilities

45

39

Other

3

3

Total other current liabilities

1,138

1,031

1 Comparative amounts have been adjusted to conform to the presentation in the current year.

The following table presents the reconciliation between the statement of cash flows and the cash and cash equivalents as presented on

the balance sheet:

million

2010

2009

Cash and cash equivalents at the beginning of the year

2,688

2,863

Restricted cash

(22)

(19)

Cash and cash equivalents at the beginning of the year, excluding restricted cash

2,666

2,844

Net cash from operating, investing and financing activities

(157)

(169)

Effect of exchange rate differences on cash and cash equivalents

70

(9)

Restricted cash

21

22

Cash and cash equivalents at the end of the year

2,600

2,688

The following table presents additional cash flow information:

million

2010

2009

Non-cash investing activities

Accounts payable at year end related to purchased non-current assets

120

128

Assets acquired under finance leases from continuing operations

28

39

Non-cash financing activities

Finance lease liabilities originated from continuing operations

(28)

(39)

Acquisition of businesses

Fair value of assets acquired

(129)

(10)

Fair value of assets given

10

Goodwill

(111)

(4)

Less: Liabilities assumed

80

Total consideration paid

(160)

(4)

Cash acquired

1

Acquisition of businesses, net of cash acquired

(159)

(4)

Divestments of businesses

Net assets divested

1

Result on divestments of discontinued operations before income taxes

(7)

(128)

Changes in accounts receivable payable and provisions - net

(27)

119

Divestment of businesses, net of cash divested

(34)

(8)